Source: businessmirror.com.ph

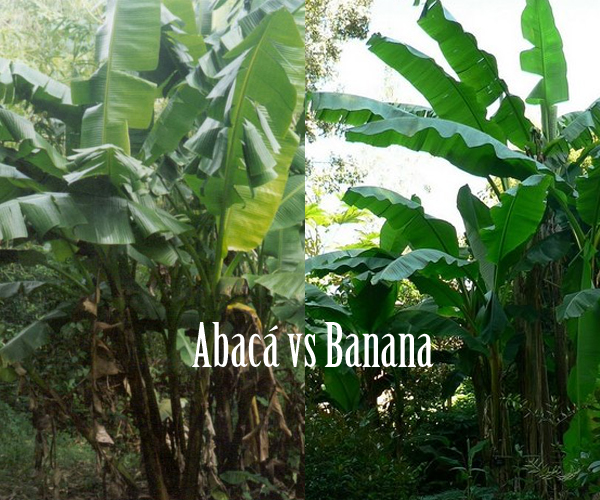

Abaca or 'Manila Hemp' plant.

WE’VE been duped twice. For one, the coconut is not a nut. For another, Manila hemp is not hemp.

But the two, especially Manila hemp, are quite synonymous to one: the Philippines.

Unlike the Russian hemp and American hemp, both of which come from cannabis sativa, Manila hemp, which is locally known as abaca (Musa textilis), is a banana.

American educator Elizabeth Potter Siever wrote in her book, The Story of Abaca: Manila Hemp’s Transformation from Textile to Marine Cordage and Specialty Paper (2009), that abaca gained its moniker “Manila hemp,” in 1800s.

By those times, according to Siever, abaca was utilized as a cordage fiber, or for rope-making, particularly those used in ships and boats. “Actually, all rope makers of the time made little distinction regarding the biological family of the fibers they chose to use, but instead called them all hemp and sometimes differentiated among them according to their country or port of origin,” Sievert said.

“It seems likely that the traders and consumers of abaca had little concern for the botanical derivation of the fiber. Rather, they saw its importance only as one of a class of fibers [hemp] that could be spun into rope and would identify abaca the port from which they received it: Manila. Hence, the term, ‘manila hemp’ or simply, ‘manila,’” she added. Because of its high tensile strength and natural length, abaca became the widely used cordage fiber by navies since then.

Land area

THROUGH the years, land area dedicated to abaca farming has been constantly expanding to meet the growing demand for its fiber.

In fact, in 2016, total land area planted with abaca rose to a decade high of 180,302 hectares, from the 141,711 hectares recorded in 2006.

However, despite the increase in land area, the Philippine Fiber Development Authority (PhilFida) noted this hectarage level is considerably small compared to other endemic crops planted in the country.

“The ratio of the total land area for abaca planting over the total land area of the country reveals that only a small portion of the country’s land area is utilized for growing abaca because abaca farms are concentrated in isolated and mountainous areas,” the PhilFida said in its newly crafted “Philippine Abaca Roadmap 2018 to 2022.”

The PhilFida estimates the average abaca farm size in the country is only about 1.6 hectares per farmer.

“Almost one third of the abaca areas can be found in Region 5 or the Bicol region, with 52,493 hectares. The land area is comparable to combined abaca areas of Regions 13, 11, 12 and 6,” it said.

“Second to Bicol region is Eastern Visayas, with a total land area of 45,527 hectares. [The] Caraga and Davao regions ranked third and fourth with areas of 19,087 hectares and 15,880 hectares, respectively,” it added.

In terms of yield, the Autonomous Region in Muslim Mindanao has the highest volume for the past 10 years, averaging at around 718 kilograms per hectare annually.

This was followed by Davao region with 509 kilograms; Bicol region with 455 kilograms; and, Eastern Visayas with 358 kilograms.

Production

DESPITE a size of farming of abaca of less than 200,000 hectares, the Philippines remains as the world’s top abaca producing country, accounting for at least 87.5 percent of global output.

In the span of the past decade, from 2006 to 2016, the country’s production of abaca fiber averaged at 67,329 metric tons (MT), according to the PhilFida.

Driven by favorable planting conditions, Philippine abaca output rose to a five-year high of about 72,000 MT in 2016.

“From 2006 to 2008 Eastern Visayas had been the leading abaca-producing region with an average of 23,560 MT,” the PhilFida said. “The last six years, however, was dominated by the Bicol region, contributing an average of 20,082 MT, or 35 percent.”

“Eastern Visayas followed with an average of 14,623 MT, or 25 percent, while Davao Region, [which] supplied 13 percent or an average of 4,376 MT, ranked third. Catanduanes consistently remained as the biggest abaca-producing province,” the PhilFida added.

Demand

IN terms of demand, local processors use an average of 49,260 MT or 76.51 percent of the country’s average yearly production of abaca fiber during the past decade, the PhilFidA said.

Abaca fiber is being processed locally into pulp, cordage and various fiber-craft items, including furniture. “The pulp sector consistently remained as the growth area of the abaca industry, utilizing an average of 37,043 MT, or 75.2 percent of the annual average local consumption and increasing at a minimal rate of 0.4 percent per annum,” the PhilFida said.

“The pulp millers’ utilization level is highly dependent on the demand for pulp by the specialty paper manufacturers abroad as abaca pulp is the raw material used in meat and sausage casings, tea or coffee bags, k-cups, bags, cigarette paper, currency paper, Nano cellulose [a material that enhances fiber strength], polyester and other specialty papers,” the PhilFida added.

Abaca pulp are usually exported to Europe, the US, Japan and China, where processing facilities capable of manufacturing specialty papers are located. There has been no specialty paper-manufacturing facility in the Philippines to date.

“The cordage sector, on the other hand, consumed an average of 8,493 MT of abaca fiber per annum, or about 17.2 percent of the yearly average usage of domestic manufacturers. Utilization decreased by 6.4 percent per year from 2006 to 2015,” the PhilFida said.

“Cordage and allied products have continuously been facing stiff competition from synthetics and other cheaper natural materials. Major cordage companies in the Philippines are the Manila Cordage and Pacific Cordage,” it added. The PhilFida, an attached agency of the Department of Agriculture, said the country’s revenue from abaca exports from 2006 to 2016 averaged $100 million.

“Some 87 percent, or an average of $87 million, came from abaca manufactures, such as pulp, cordage, yarns, fabrics and fiber crafts,” the PhilFida said. “The rest [13 percent] was from raw fiber exports with yearly average earnings of $12.94 million.”

Some of the top buyers of the country include the United Kingdom, Germany, China, Japan and the United States. The same applies for exports of abaca pulp and other manufactures.

No comments:

Post a Comment