Summary

- Marijuana stocks have been incredibly volatile since the cannabis revolution began in 2014.

- Until 2016, new state legislation will be hard to come by, which will be more of a burden to those companies solely focused on recreational or retail based marijuana sales.

- In the cannabis sector, investors are finding more opportunity with stocks with companies that focus on the biotech space with products in the pipeline for FDA approval Vs state approval.

- Biotech historically has shown a more consistent growth pattern comparatively speaking.

Long has been the stigma that marijuana stocks are something to be leery of especially with how many portfolios have been riddled with losses during the midst of the marijuana blitz. Analyzing the industry as a whole and looking back at the first year in history where marijuana has been legal, we can really study what the good investments were and what trades were not so profitable.

With such a burgeoning space there is way more "noise" that can affect the success of companies involved within this space. These include local business chambers of commerce, political opposition, and federal regulation, but one aspect that flies under the radar, so to speak, has been involvement within biotech and pharmaceuticals. Furthermore, hemp's legal status has made it an attractive target for companies looking to steer clear of the conflicting U.S. law that surrounds the medical cannabis industry.

Look at a company like GW Pharmaceuticals (NASDAQ:GWPH). This is a British based biopharmaceutical company, which has become well-known for its novel approach to pharmaceutical therapy. The company's multiple sclerosis treatment product, Sativex, (nabiximols) is the first natural cannabis plant derivative to gain full market approval in any country. Over the last 18 months during the "dawn of marijuana legalization", this was one of the stocks to watch. Share prices skyrocketed to highs of over $110 per share all while the company continued to make announcements on successful clinical trials.

Since hitting those highs, GW's stock price has pulled back but not to a point of crumbling. The company's recent update on its development program for Epidiolex(NYSE:R) in the field of severe, drug-resistant childhood epilepsy sparked a strong surge in momentum. The update was made in conjunction with the company's announcement on the results from its first of three Phase 3 trials for the investigational product Sativex in "the treatment of pain in patients with advanced cancer who experience inadequate analgesia during optimized chronic opioid therapy".

January 8 was when these announcements were released and on that day alone the stock price jumped 18% from open to high and reached a level above $80/share. This is a price that GWPH shares have not seen since late November and marked the first time that the stock showed signs of reversing from the previous downtrend just prior to the close of 2014. Furthermore, GWPH could be looking at a bull-flag pattern, setting up for a possible break to higher levels. As you'll see with these additional cannabis biotechs, the entire sector seems to be lifting right now.

Currently GW Pharma shows that its burn rate from operations is roughly $1.7M/mo. This is significantly higher from prior years and a potential point of risk for GW. Being that the company is very dependent on its single product, Sativex, investors should be aware that though this is a larger market cap company in the cannabis space, there are regulatory approvals that will still need to be met by the FDA in the US.

This leads me to INSYS Therapeutics, Inc. (NASDAQ:INSY). Monday morning, the company announced progress and "expected milestones" for multiple projects in its pipeline of supportive care and therapy products & candidates. For this company, Insys focuses on a sublingual spray as a delivery method and is moving forward with research and trials for pharmaceutical cannabinoids both for pain therapy in cancer patients as well as treatment for pediatric epilepsy. The company has already submitted an Investigational New Drug application for the pharmaceutical cannabidiol formulation for the treatment of epilepsy.

In a recent press release, the company focused on development in 2015 citing that it will be conducting Phase III studies for its buprenorphine sublingual spray for the treatment of acute pain and expects to complete this by 2016. Additionally, Insys has recorded positive outcomes of its Phase I study of its sublingual spray buprenorphine/naloxone candidate as well as filing an Investigational New Drug application for its ondansetron sublingual spray candidate, expecting it to complete a pilot pharmacokinetic study in the first quarter of 2015.

This mix of positive news, new studies in the pipeline and positive results from its most recent quarterly filing have helped to propel the stock to new highs and continue the latest bull-run. The results include a 90.7% Gross Margin, a 99% increase in net revenues from the same quarter 2013 by nearly $30M, and an increase in net cash provided by operating activities by $20M for the nine month period ending Sept. 30 compared to the previous period in 2013. INSY operates very lean as evidenced by the cost of revenue being only about 1% of the total Gross revs.

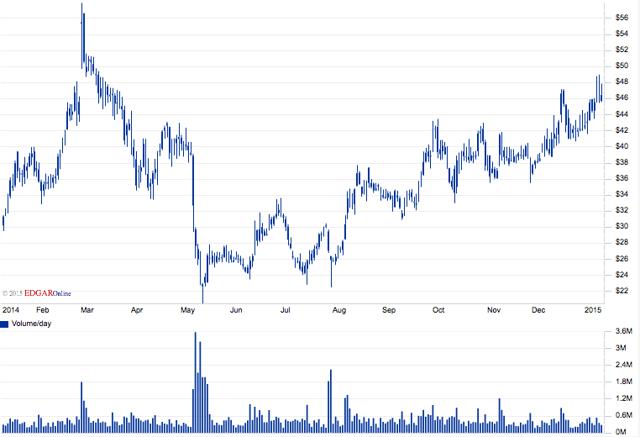

Even if the company remains constant with its operations and reports an average of $10m in net income per quarter, INSY operates at roughly 39x earnings. Furthermore, the company operates fairly lean. In line with this, the share price has remained on an upward trend since May of last year. After churning between $22-$24 per share for nearly the entire summer, INSY made an about face and hasn't looked back ever since. As of this report, the stock has managed highs of $49 as of Jan 14, 2015 and doesn't show many signs of pull-back.

As hemp gains more popularity for a source of CBDs, its legal status has made it a very appealing target for companies looking to avoid the U.S. law that surrounds the medical cannabis industry. For instance, in 2004, the U.S. Supreme Court ruled in HIA v. DEA that hemp would be legal to cultivate and process for sale "as a food or beverage in the United States". The 2014 U.S. Farm Bill permitted cultivation of domestic hemp in states like Colorado on a limited basis and just recently Senate Bill 134, to "legalize industrial hemp cultivation and production", was filed and assigned to a Congressional committee on Thursday, January 8, 2015 by Senator Ron Wyden (D-OR) and co-sponsored by Senator McConnell (D-OR), Senator Merkley (D-OR), and, Senator Rand Paul (R-KY). The bill titled "Industrial Hemp Farming Act of 2015" would "remove federal restrictions on the domestic cultivation of industrial hemp."

In both cases (Farm Bill & Industrial Farming Act) the approval of these new bills could make 2015 a banner year for new innovation within the biotech space especially for companies focused on extracting the benefits from hemp. The reason for this is because up until recently, companies manufacturing hemp-based products were forced to import the raw material. Aside from GW Pharma and Insys, other companies are also coming on board and adopting a more biotechnology focused approach to the market opportunity in this burgeoning cannabis space.

Take a company like PEAK Pharmaceuticals Inc (previous, Cannabis Therapy Corp) (OTCQB:CTCO), which has received increased market attention following its name change and recent focus on the animal markets. Recently the company signed a worldwide license agreement with Canna-Pet LLC and a cultivation agreement with a Colorado-based hemp farm. This should bode well for PEAK not only for opportunity for growth in the medical cannabis space but also in the pet markets as well. According to the American Pet Products Association, the U.S. pet industry has grown at an 8% CAGR to reach $58.51 billion by 2014.

Thursday the company announced favorable sales results for its Canna-Pet product. According to PEAK, the company has processed and shipped more than 3,000 orders. A mix of news and financials that hold over $4m in paid in capital, should appeal to new investors as the company itself has such a vested interest in continued progress within the CBD space.

Net cash used in operating activities was $933,475 for the year ended September 30, 2014, as compared to net cash used of $15,567 for the year ended September 30, 2013. According to the company, this increase in net cash used in operations was primarily due to the change in operating plans. Note that share price, market volatility and posting a net loss for the year of $3,758,815 are all very important risks to be aware of when looking at Peak as a potential investment option in the biopharma/cannabis market.

Oxis International, Inc. (OTCPK:OXIS) (OXI.PA) through its subsidiary, Oxis Biotech, Inc. has recently come into the space as well. It appears that following the company becoming current with its filings as well as releasing two very prominent pieces of press, activity in the stock has increased with January 14 seeing the highest volume day in the stock. Over the last 30 days, Oxis shares also have seen highs of $0.039 even with the caveat status on OTC Markets. This was an obvious trigger to take a closer look as seemingly, "something's up".

Over recent weeks, the company has made two announcements that put this on the list of possible cannabis investments in 2015 and both are material in nature. Further diligence shows that not only has Oxis executed definitive agreements licensing certain assets for the treatment of multiple myeloma but the company has also brought on one of the foremost authorities in CBD research especially those diagnosed with multiple myeloma, breast cancer, and even research in the stem cell arena, Dr. Sean Xie (Dr. Xiangqun Xie). According to the website cbdligand.org, "Xie's research work is beyond the proof-of-principle stage since his group has already successfully identified several novel CB2 ligands with nanomolar receptor binding affinity (US patents). The methods and results developed will have a significant impact on the other GPCRs drug research in general. Currently, he has established collaboration with MD experts in University of Pittsburgh Medical Center for in vivo animal evaluation."

In addition to this, the Company also announced that Dr. James J. Mulé, Ph.D. who is a Special Government Employee of the NCI and the FDA, joins that company's Scientific Advisory Board. Among many of his accomplishments, Dr. Mulé is recognized for his translational research studies in cancer immunotherapy. Mulé previously worked with Oxis CEO Tony Cataldo when Mr. Cataldo previously formed Genesis Biopharma (previous GNBP) which later became Lion Biotechnologies. Under the helm of Mr. Cataldo, Genesis came from a penny stock and built enough shareholder value to increase to $8+ per share.

As far as paid in capital is concerned, Oxis shows more of a vested interest along the lines of a company like Insys as opposed to one like PEAK. Therefore it could be very possible that the CEO who took Genesis to "the next level" may have found another company to build as OXIS has continued to gain more investor interest this past week. Despite these achievements and increased market liquidity, the obvious risks unassociated with the small market cap, lower share price, and volatility will also include the fact that Oxis will still need to put in place a plan or outline for what the company will focus on specifically. A strong team to conduct R&D is a good start but as the company has just become fully reporting, the need for more company developments regarding production is needed in my opinion.

As noted in several instances, I've mentioned paid in capital in this article for the simple fact that many biotechs generally are pre-revenue through the multiple stages of R & D and phases of FDA approval. This valuation method has been used because when you're not selling product, how can success be determined? By utilizing "paid-in-capital" valuations, investors can clearly see that amount of capital available to fund a biotech company's research.

Investing in cannabis companies in the US at this point remains highly speculative and obvious risks reach far beyond simple market volatility. As far as biotechs go, drugs not passing FDA approval or even reacting negatively during the trial periods can put a huge barrier up for a company. For the cannabis industry as a whole (even though it doesn't necessarily effect biotechs) federal regulation can change at any point and time so just as the government made certain aspects legal, they can easily overturn those to make them illegal. The main point is that by investing in reputable companies focused on biotech may produce significant returns in the current climate as many states have not legalized the drug for over the counter sale.

The real investment right now I feel is in the biotech side of the space. For one, as far as regulatory issues are concerned, these companies do not face the same state-by-state restrictions that many typical marijuana based businesses face. Much of the studies are funded by government-sponsored funds and thus would have to meet the criteria of organizations like the FDA. This makes biotech a great candidate through 2016, which is when the next elections are planned & potential legalization votes go back on the ballot. Second, the biotech space is growing at an annual rate of 11% (market revenue is just under $300B according to IBISWorld). Finally, The Arcview Group forecasts that the legal marijuana industry will increase to $10 billion in 2019, so there is obvious opportunity within the industry just as it is beginning to grow. As history has proven with growth driven industries, the first-movers who take an early foothold manage to gain the largest market share. What companies like Google and Apple have done for tech, cannabis biotechs like those mentioned can do it for the marijuana industry.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment