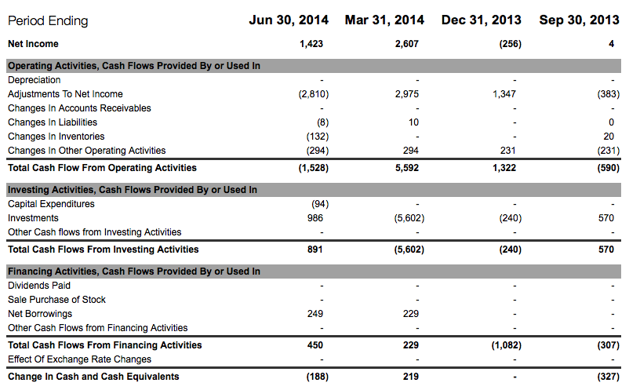

Source: seekingalpha.com

Summary

- Hemp Inc. one of the first stocks of the PotCOM boom.

- Insider trading of Bruce Perlowin, David Tobias, and Craig Perlowin revealed for the first time on a public forum.

- Estimated $11 million in profits from selling shares of Hemp over the past 2.5 years.

- Current share structure makes this deal unsalvageable.

- With no discernible operations to date, we must come to the conclusion that Hemp Inc. has been nothing more in the past two years than a pump and dump scheme.

Recently, I published a piece on the Pot Stock Millionaires of 2014. There were a few names missing that should have made the list. One in particular was Bruce Perlowin of Hemp Inc. (OTCPK:HEMP).

Bruce Perlowin's name should be familiar to most pot stock investors. In 2012, Bruce was featured on CNBC "60 Minutes' Rocky Mountain High" as the King of Pot. In his heyday, Perlowin smuggled nearly 300-thousand pounds of marijuana and served 15 years for felony charges.

Now, Bruce doesn't have to sell pot to make millions. He just has to sell pot stocks.

Hemp Inc.: Emerging Company Or Stock Selling Scheme

Hemp Inc. was incorporated in the state of Colorado as Preacher's Coffee in 2008 and changed its name to Marijuana Inc. in 2009. The company changed its name one final time in 2012 along with going public.

According to the latest filings, the company's "primary focus shifted to industrial hemp and the myriad of clean, green sustainable products that industrial hemp offers to the world."

However, the company does not actually produce, grow, distribute or sell hemp.

But it is planning to. Soon.

Hemp's operations have been questionable to say the least. For the past few years, it appeared as though Hemp's primary operations were holding shares of other pot stocks. For instance, in exchange for the 10.5 million shares held of Medical Marijuana (OTCPK:MJNA) by officers and directors of Hemp, beneficial owners of Hemp were awarded 307 million shares. Recently, Hemp sold its MJNA securities

Only this year has Hemp actually made concerted effort to enter the hemp business.

"On May 12, 2014, the Company purchased decortication equipment for processing kenaf, a fibrous plant used in industrial, commercial, and consumer applications, and for the anticipated future processing of hemp. On August 7, 2014 the Company acquired a 70,000 square-foot North Carolina factory building on 8 acres to house the decortication equipment along rolling stock and forklifts."

In their most recent press release, the company disclosed that "it is currently illegal to grow hemp in North Carolina." This would have probably been useful information to find out BEFORE acquiring the facility.

So still, no operations.

Kind of a long time for a company with a $157 million market to not have any real business operations

So, what's been going on over the past two and a half years?

In a nutshell: nothing except dilution and selling shares.

Insider Trading of Pink Sheets

Hemp trades on the pink sheets and so it is not required to file financial statements or periodic reports with the SEC. The problem with pink sheet tickers is that you never know when insiders are dumping. When an insider wants to sell shares valued over $5,000 or 50,000 shares or more, he or she has to file a form 144.

Although insiders submit their form 144 to the SEC, the SEC does not make these forms accessible via Edgar.

Of course, there are some caveats: as an affiliate, you can't sell more than 1% within a 3-month period AND you have to report shares sold within the last 90 days. Also, if the shares were issued from a non-reporting issuer (aka, does not file with the SEC), you have to wait a year.

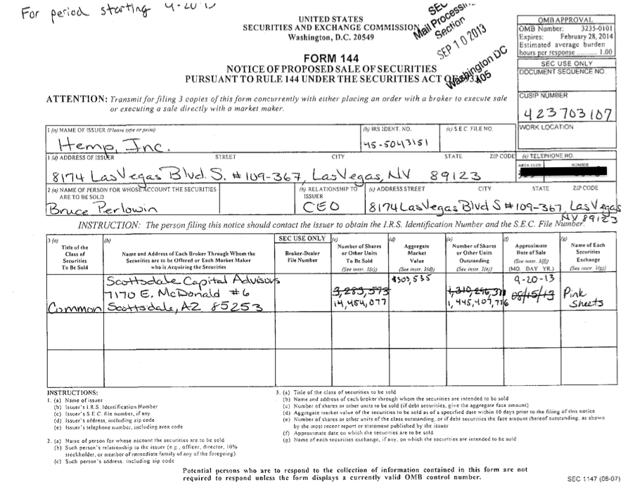

So, guess what CEO Bruce Perlowin tried to do one year barely one year after it was incorporated? You guessed it: dump 1% of his shares.

The Beginning of PotCOM, CIRCA 2012

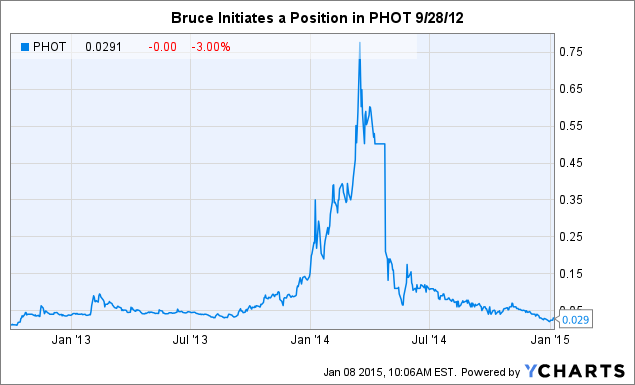

The coverage on 60 Minutes was a real turning point for the pot stock investing world. Overnight, several thinly traded penny stocks were injected with millions of dollars of investor liquidity. And Bruce and his buddies benefited greatly.

*Chart From Sept. 1, 2012 to Dec. 31, 2012

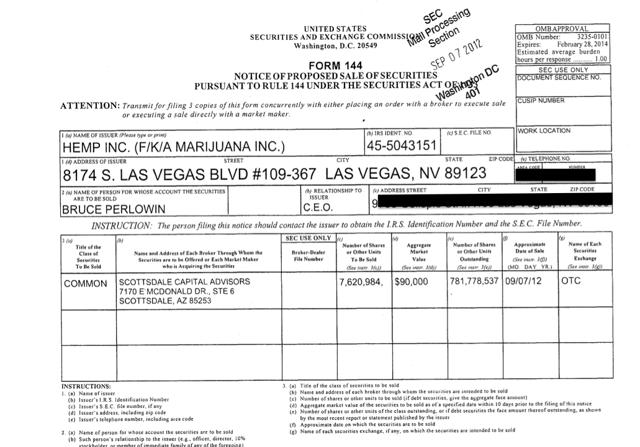

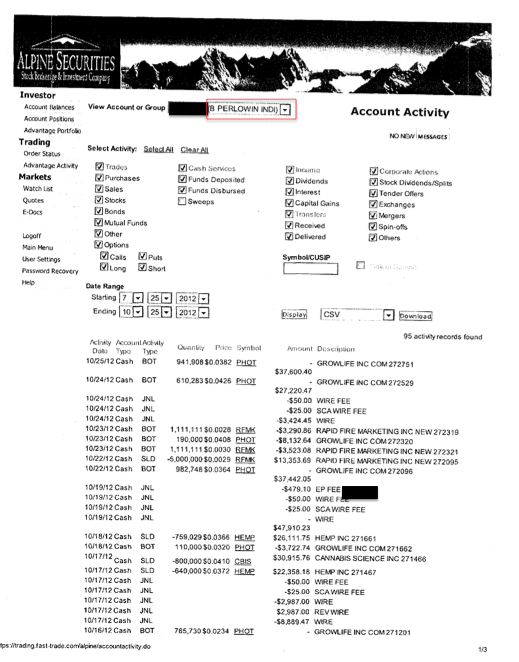

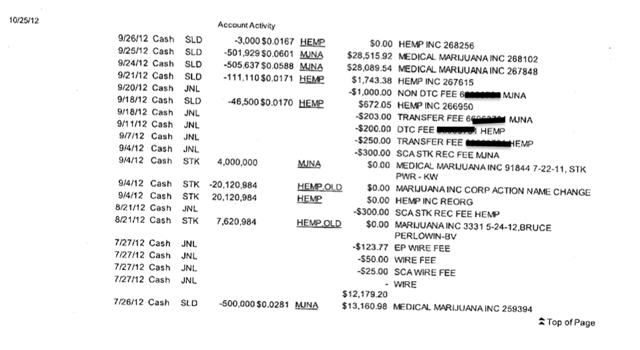

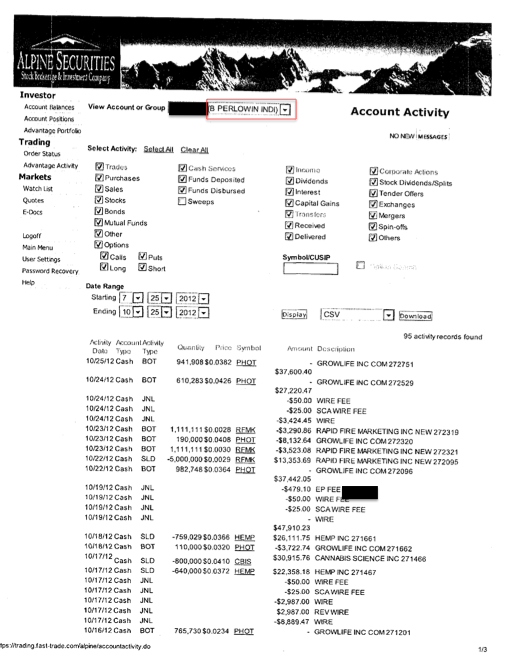

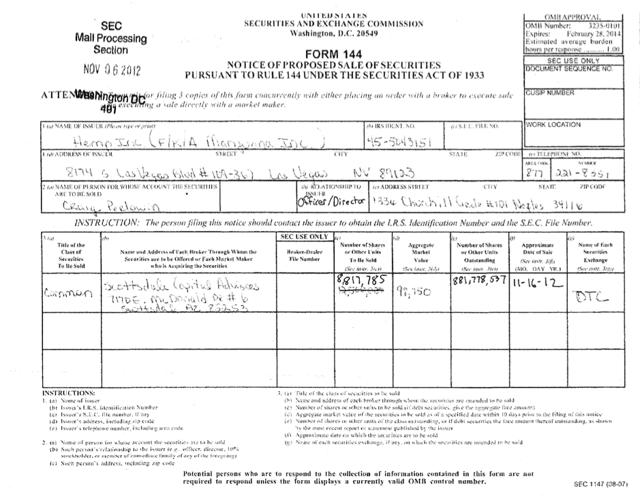

The 60 Minutes special was set to air Oct. 21, 2012. But Perlowin did not wait to start dumping shares. Within five months after filing the initial company information and disclosure statements on March 1, 2012, Perlowin filed to sell 7,620,984 shares on August 27, 2012 for estimated proceeds of $90,000.1

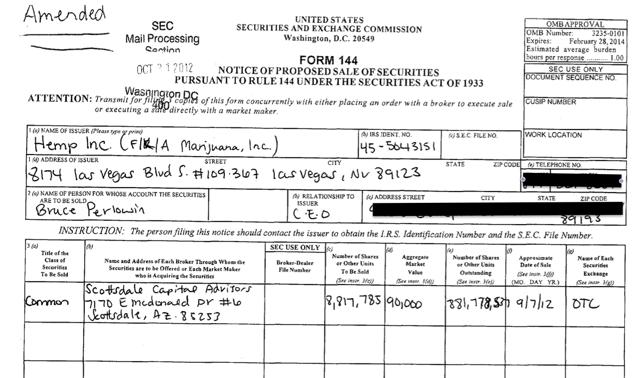

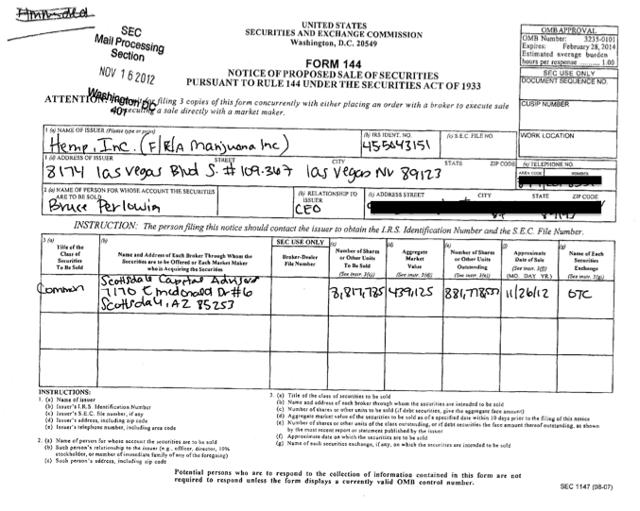

But he ran into a couple of issues. As a result, Perlowin amended the filing not just once, but twice.2

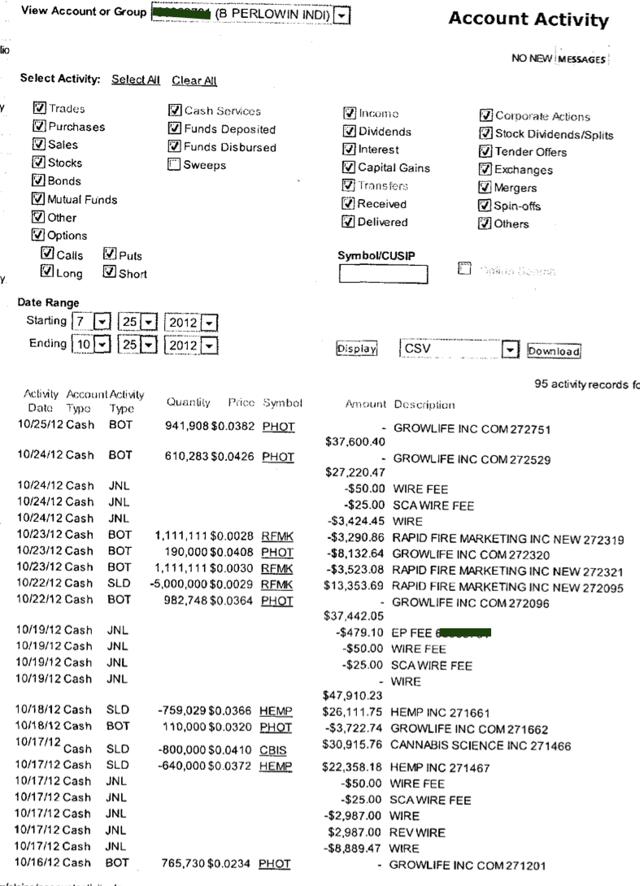

What Perlowin accidentally submitted to the SEC on the second go around was about three months worth of day trading pot stocks. In short, Perlowin was dumping his company's shares to buy shares in other companies.

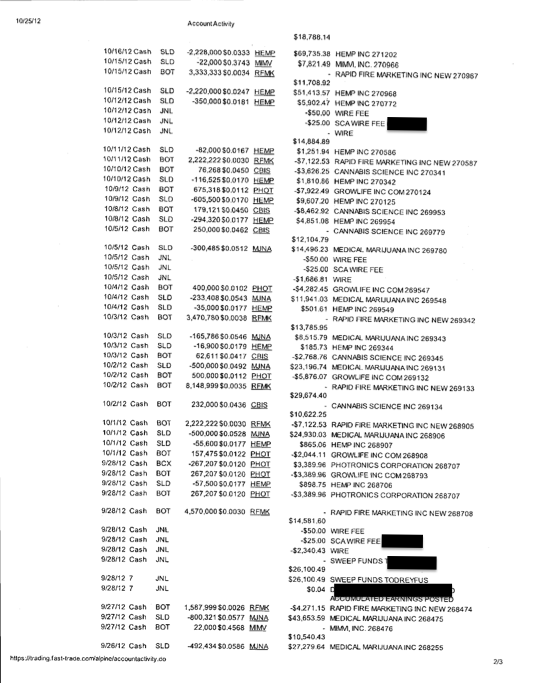

From July to October, Mr. Perlowin disclosed 50 trades in total. Mr. Perlowin sold 4.4 million shares of Medical Marijuana and 6.1 million shares of Hemp Inc. to buy Cannabis Science (OTCQB:CBIS), Rapid Fire Marketing (OTCPK:RFMK), and Growlife (OTC:PHOT).3

During the three months, Mr. Perlowin pocketed $283,000 from MJNA and $196,000 from Hemp only to spend $88,000 on buying RFMK stock, $155,000 for PHOT, and $41,000 for CBIS.

It gets weirder.

Bruce ends up disclosing these holdings on Oct. 15, 2012. In a press release predicting, "Spike in Medical Marijuana and Industrial Hemp Stocks for Entire Industry Sector," Bruce tells the entire investing world,

"Hemp, Inc.'s CEO, Bruce Perlowin, has accumulated over twenty-two million shares of stock in Rapid Fire Marketing, Inc.; eight hundred thousand in Cannabis Science, Inc.; two million in Grow Life, Inc.; and, twenty-one million shares in Medical Marijuana, Inc. Even though his favorite is his own (Hemp, Inc. ) he has started strategically investing in other marijuana industry stocks. "I know these stocks are going to go through the roof," says Perlowin."

Same day he sold 2.2 million shares of his "favorite" stock for $51,000. The following two days he sells another 3.6 million shares of his company's stock for another $120,000. That's $190,000 in three days.

Unfortunately for Bruce, CBIS and RFMK did not "go through the roof" and he sold all of his CBIS shares for a ($7,000) loss and 5 million RFMK shares for a ($6,000) loss, but holds onto 18 million shares at an average price of 0.0039 a share.4

Trades Following 10/15/12 PR "Spike in Medical Marijuana and Industrial Hemp Stocks Projected for Entire Industry Sector"

| |||

Date

|

Ticker

|

Shares

|

(buys) Sells

|

10/15/12

|

HEMP

|

2,220,000

|

$51,413

|

10/15/12

|

RFMK

|

333,333

|

$(11,708)

|

10/15/12

|

MMIV

|

22,000

|

$(7,821)

|

10/16/12

|

PHOT

|

(765,730)

|

$(18,788)

|

10/16/12

|

HEMP

|

2,228,000

|

$69,735

|

10/17/12

|

CBIS

|

800,000

|

$30,915

|

10/17/12

|

HEMP

|

640,000

|

$22,358

|

10/18/12

|

PHOT

|

(110,000)

|

$(3,723)

|

10/18/12

|

HEMP

|

759,029

|

$26,112

|

10/22/12

|

PHOT

|

(982,748)

|

$(37,442)

|

10/22/12

|

RFMK

|

5,000,000

|

$13,354

|

10/23/12

|

RFMK

|

1,111,111

|

$(3,523)

|

10/23/12

|

RFMK

|

1,111,111

|

$(3,291)

|

10/24/12

|

PHOT

|

610,283

|

$(27,220)

|

10/25/12

|

PHOT

|

941,908

|

$(37,600)

|

Given the nature of his trading activity, Bruce most likely didn't wait till December 2013 to sell his RFMK holdings for a ($70,000) loss.

Despite his loss in RFMK and CBIS, Mr. Perlowin probably did more than okay with his 6 million PHOT shares purchased at an average $0.025 as long as he sold before the halt.

A month later, Hemp revealed in a PR that "Perlowin is also heavily vested in GrowLife, Inc. and is collaborating with that company in the marketplace." What the PR should have said was that Perlowin just threw down $150k at $0.025 a share and is looking to make some money.

While Bruce only planned to make $90,000 from selling 7 million Hemp shares, he came away with $200,000 instead, proving just how lucrative pot stocks can really be for insiders.

But the amount of cash moving from investors to insiders, coupled with the subsequent decline in stock price, suggests that Hemp has been nothing more than a vehicle to move money from the hands of investors into the hands of guys like Bruce Perlowin.

Becoming a Pot Stock Millionaire

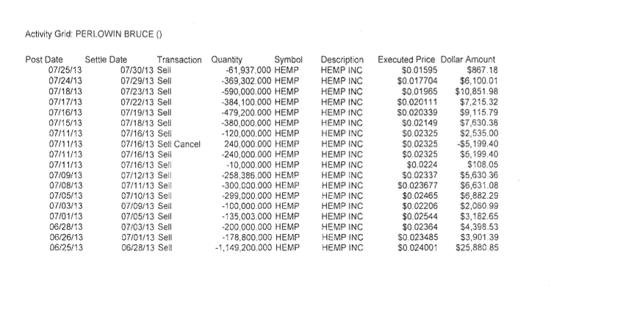

Bruce did not become a millionaire in 2012, but he sure did in 2013. And then doubled his wealth in 2014.

2013

- Bruce filed to sell another 8 million shares on Nov. 26, 2012, the same day that Hemp's quarterly report was released. Expected gross: $440,000.

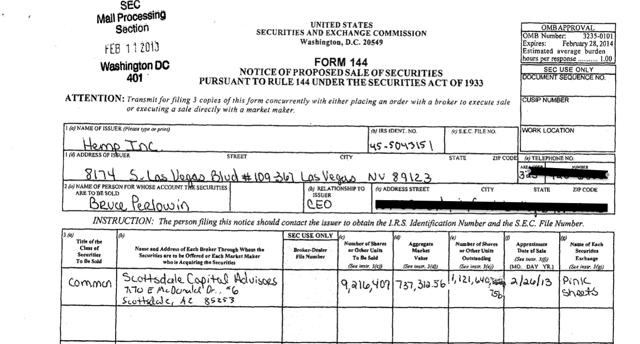

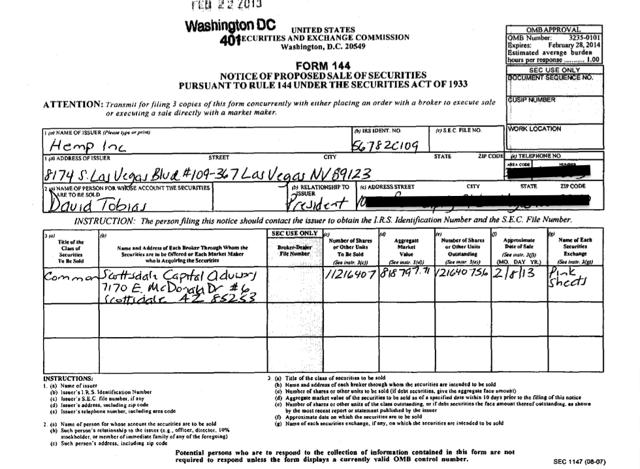

- Leading up to his proposed sale for 9.2 million shares on Feb. 26, 2013, Hemp puts out a PR stating, "Recent activity in the markets has pushed the industrial hemp and medical marijuana sectors to new heights, setting a record volume for Hemp, Inc."5 Expected gross was $740,000 for shares sold.

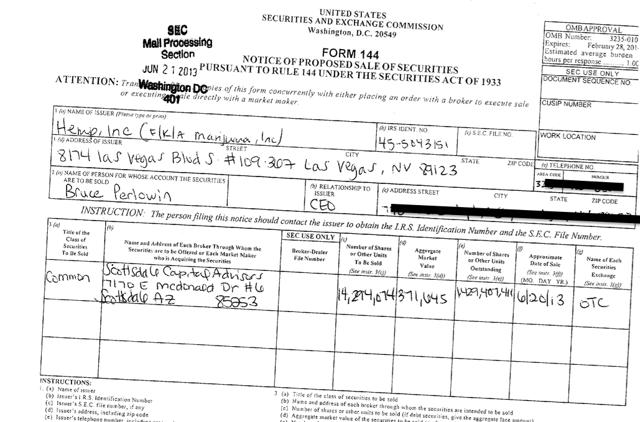

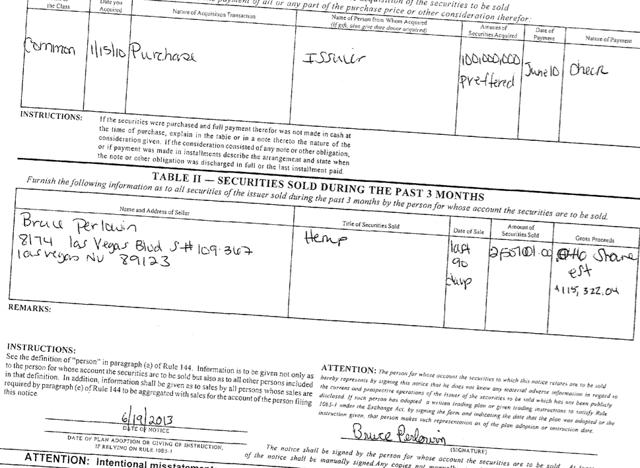

- Hemp updates shareholders of the progress of its "Hemp Crop in China" onJune 20, 2013 and Bruce files to sell 14 million shares for $370,000.6Discloses selling 2.5 million shares for $115,000.

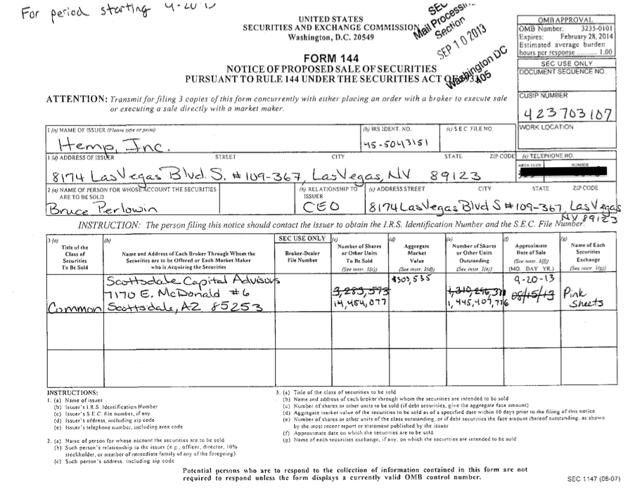

- By Sept. 20, 2013, Hemp's enthusiastic PRs are losing steam. Best he can come up with is one where Hemp announces that Bruce was on the radio. Yawn. Bruce files to sell another 14 million shares for $300,000.7 Reveals 8.4 million shares were sold for $102,000.

2014

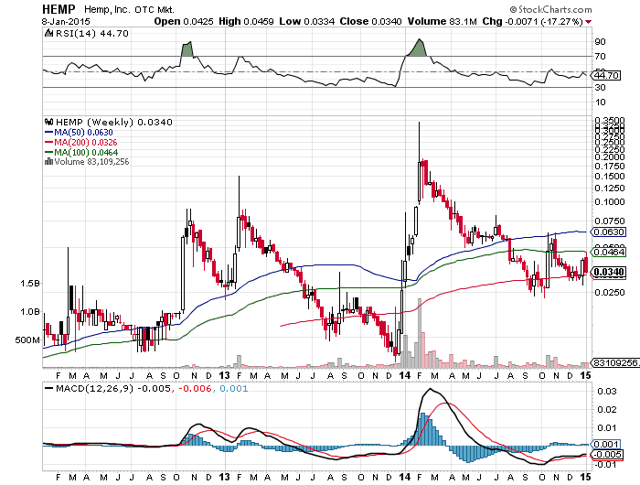

For the first half of 2014, Bruce, for whatever reason, took a break from filing form 144s, and arguably, from dumping Hemp shares. This is surprising since Hemp's stock price hit $0.25.

Not until July do we get our first form 144:

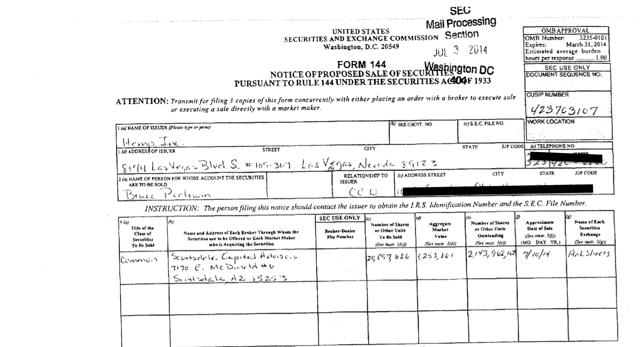

- On 7/10/14, Proposes to sell, 21 million shares for $1.2 million.8

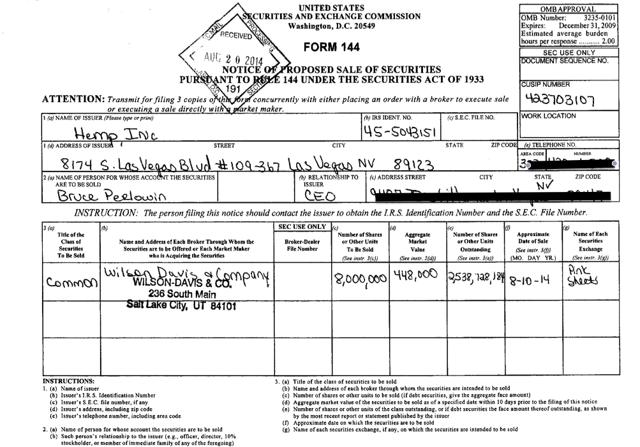

This is where it gets weird again. Rather than waiting the required three months, Bruce files again one month later.9 This time, he proposes to sell 8 million shares for $448,000. Was this an amendment? Did he not sell in July?

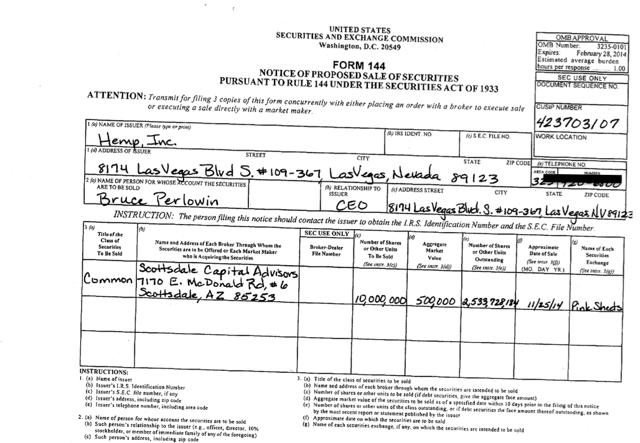

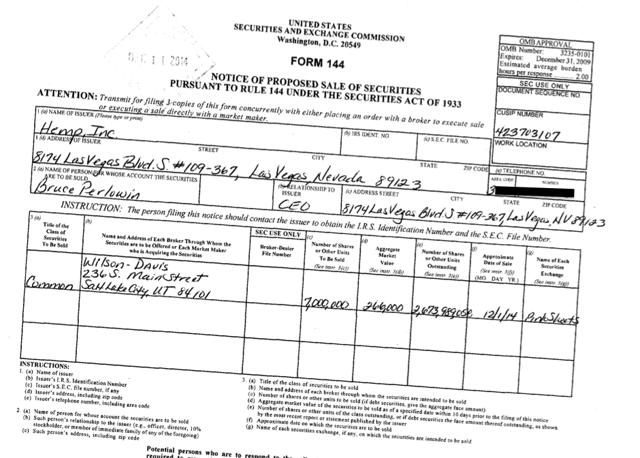

If he sold, the only possible justification for this apparent breach of SEC rules was that Bruce filed to sell the shares with two different brokers. The July filing was sent to Scottsdale Capital Advisors. The August filing was sent toWilson-Davis. Otherwise, Bruce would have been over the 1% limit.

Maybe one broker didn't sell shares?

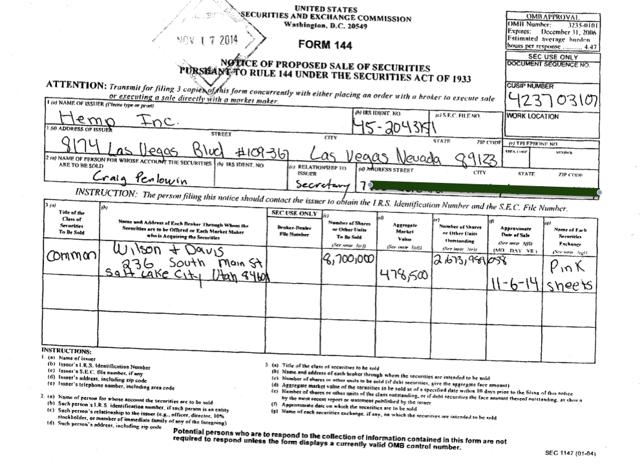

It's possible. But the same thing happens in November and December. Bruce Files two form 144s with two different brokers four months after filing ones in July and August. The November filing was sent to Scotts Dale Capital Advisors, same broker July. Proposes to sell 10 million shares for $500,000.10 No disclosure of prior shares sold within the last three months.

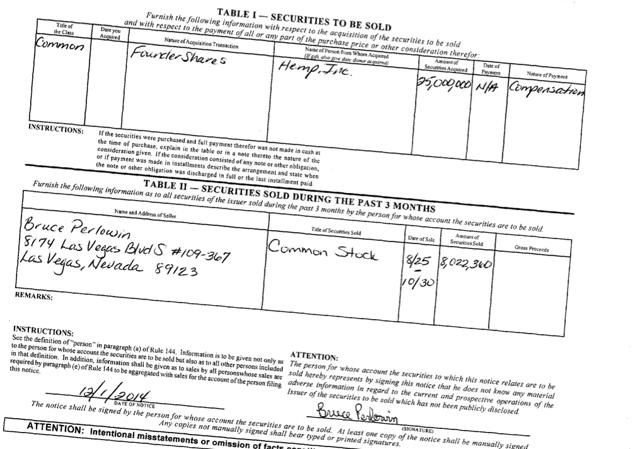

The December filing was sent to Wilson-Davis, again four months after the August filing. Bruce proposes to sell 7 million shares for $266,000.11 In contrast to the November filing, Bruce does disclose selling 8 million shares between August and October, but does not reveal the gross proceeds.12

How Much Did Bruce Make?

In total, Bruce proposed to sell 130 million shares of Hemp for $5.5 million and disclosed 30 million shares sold for $800,000. Bruce may have pocketed $5.5 million from selling 100 Hemp shares, $2.5 million of which from 2014 alone.

Disclosed

|

Proposed

| ||

Profits

|

Total

| ||

2014

|

$320,894

|

$2,467,861

|

$2,788,755

|

2013

|

$266,000

|

$1,851,618

|

$2,117,618

|

2012

|

$188,799

|

$439,125

|

$627,924

|

Total

|

$775,693

|

$4,758,604

|

$5,534,297

|

Shares Sold

|

Total

| ||

2014

|

8,022,360

|

45,597,956

|

53,620,316

|

2013

|

12,944,130

|

37,994,558

|

50,938,688

|

2012

|

7,288,164

|

16,438,769

|

23,726,933

|

Total

|

28,254,654

|

100,031,283

|

128,285,937

|

Price Per Share

|

0.0275

|

0.0476

|

0.0431

|

Low

|

High

|

Mid

| |

Est. Total Profits

|

$3,527,863

|

$5,534,297

|

$ 4,618,794

|

We don't know the exact amount that Bruce was able to make from selling his shares of Hemp. Based on the discrepancy between the price per share reported for disclosed sales and the price per share for proposed sales, it might be the case that Bruce overestimated how much he could make from selling his shares.

For now, we'll assume that he was able to make $5.5 million from selling his stock, but let's keep in mind that he may have made less.

Keeping Up With The Perlowins

Perlowin has not only used Hemp's liquiding to pamper his wallet, but he has also helped out his family. His brother Craig and Gloria Perlowin (wife of Craig?), became very wealthy over the past few years.

The Millionaire Secretary

This is one for the books: Craig Perlowin might just be the first millionaire secretary. From 2012 to 2014, Craig Perlowin sold an estimated 42.5 million shares for estimated proceeds of $2.7 million.

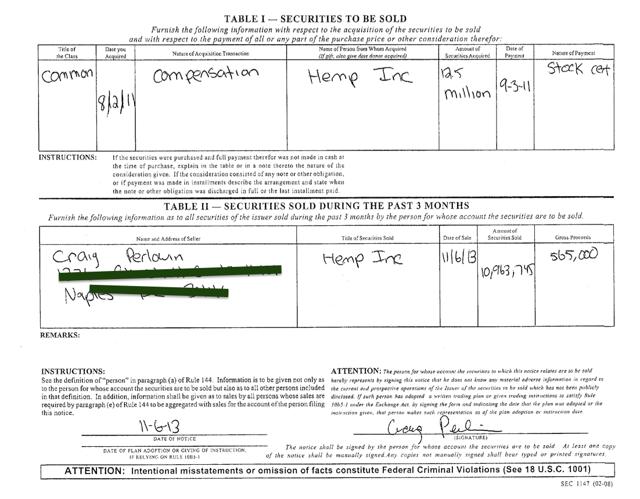

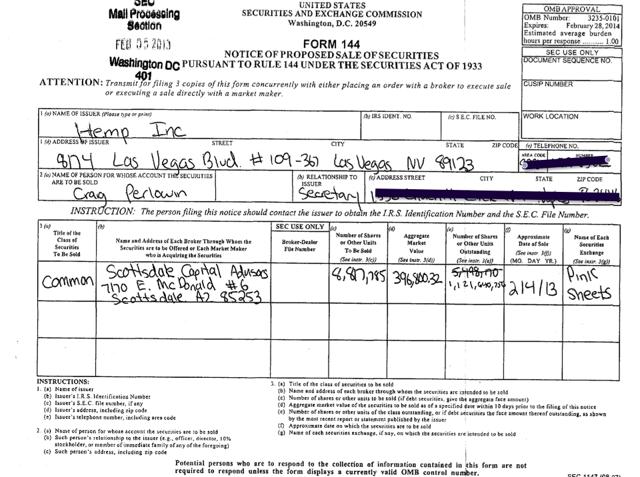

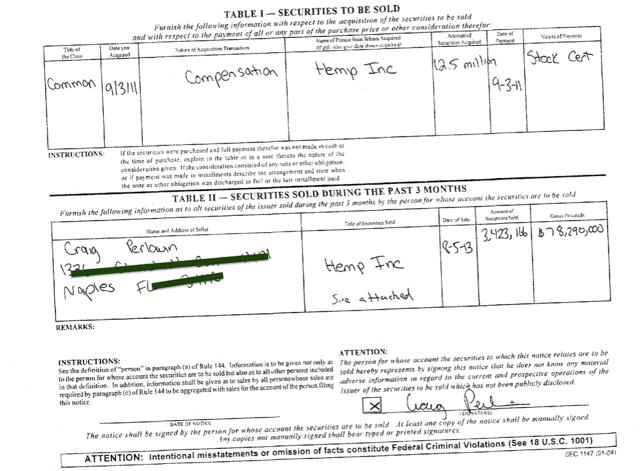

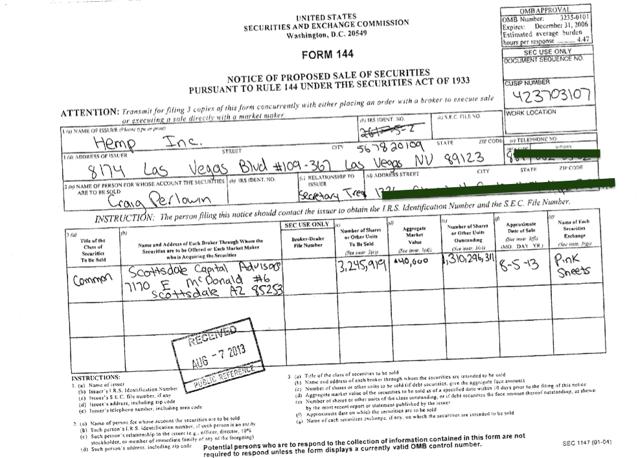

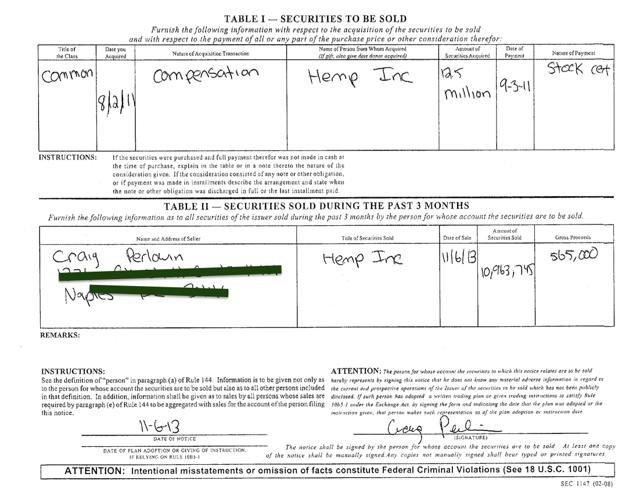

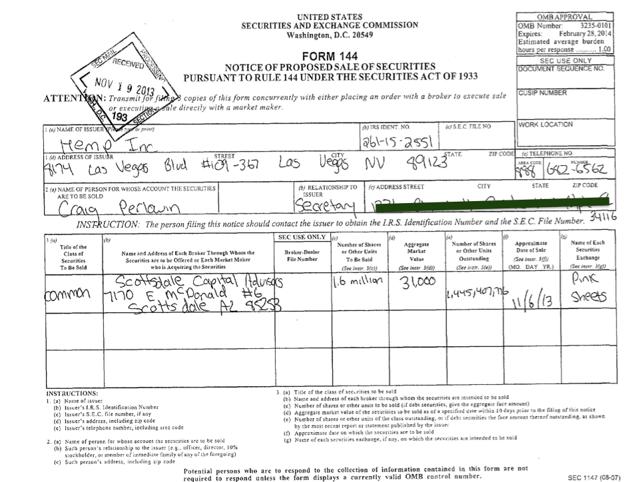

In the initial company information and disclosure statements, Craig is awarded 12.5 million shares as compensation for being the company's secretary. Just like his brother, Craig files his form 144s to get rid of his Hemp shares as fast as humanly possible.

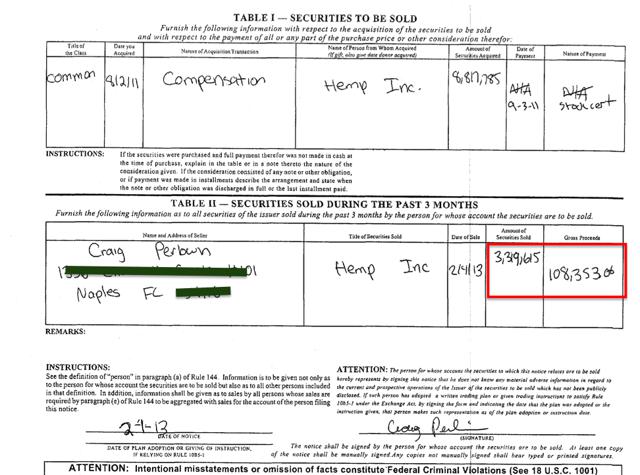

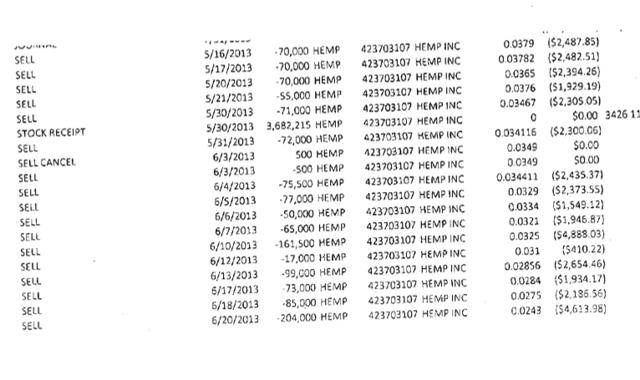

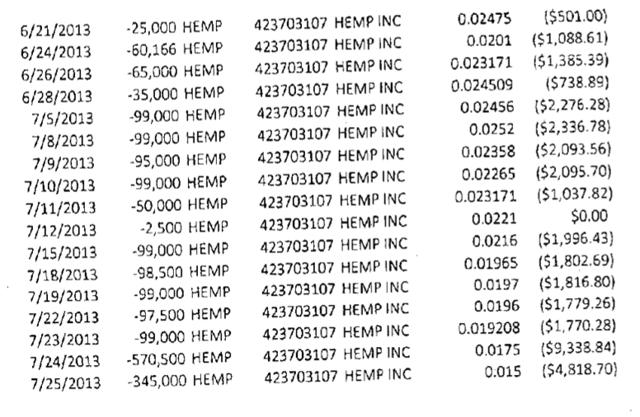

Starting in November of 2012, files to sell 8.8 million shares for $98,000.13Instead, between November 2012 and February 2013, Craig sells 3.3 million shares for $108,000.14

Now Craig is starting to feel that 'pot stock fever.'

On Feb. 1, 2013, Craig files to sell an additional 8.8 million shares at $0.045, hoping this time to make $400,000.15 Craig does one better. He sells 5.9 million shares at $0.06 for $354,000.16

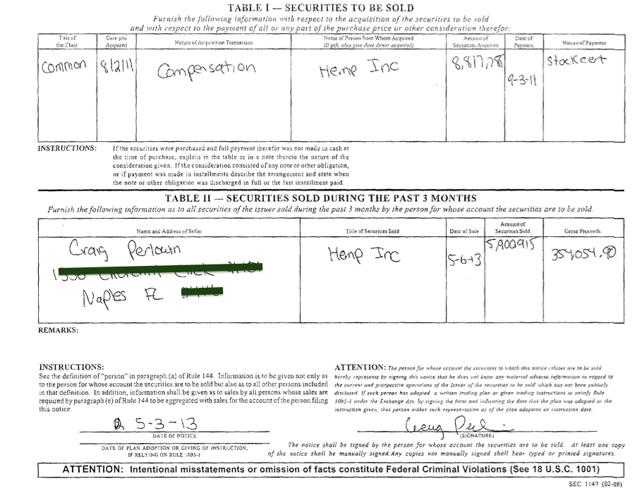

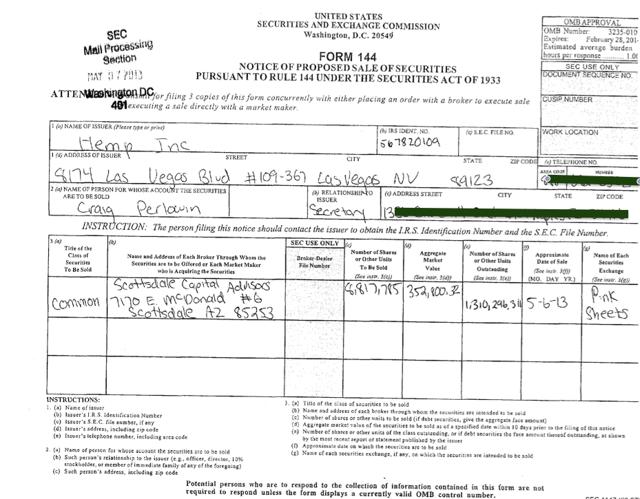

On May 3, 2013, Craig shoots to sell 8.8 million shares for $353,00017 but only makes $80,000 this time from selling 3.4 million shares.18 You know what they say, if at first you don't succeed, dump, dump, dump again.

But Craig is happy to take what he can get. He's not greedy. On August 7, 2013, Craig files to sell 3.2 million shares for $40,000.19

It seems that lady luck was on Craig's side because right before the holidays he sold a whopping 10.9 million shares for $565,000!20 Just for the love of it, proposes to sell another 1.6 million shares for $31,000.21 Wow, Craig sold 23 million shares for $1.1 million in 2013!

Wait a minute…

It's possible that Craig may have improperly filed his form 144s andoverstated his stock sales. He reported selling 23 million shares in 2013 when it clearly states in both his form 144s and Hemp disclosures that Craig only had 12.5 million shares:

"Mr. Craig Perlowin is compensated through stock in the Company based upon the schedule in his consulting contract of July 2011. In accordance with the contract Mr. Craig Perlowin was given 12,500,000 shares of restricted common stock. The total pay-out for the consulting agreement is the 12,500,000 shares of stock Mr. Craig Perlowin has already received. Mr. Craig Perlowin owns 12,500,000 shares of Common stock."

I don't think this was intentional. It's possible that for the November filing, Craig mistakenly added up all the shares he sold for the year and added up his gross proceeds: $581,000.

No biggie. It's easy to make mistakes, although one would expect a little more from a secretary making a million or half a million for the year. In fact, proper record keeping organization is kind of in the Secretary's job description:

"A person, usually an official, who is in charge of the records, correspondence, minutes of meetings, and related affairs of an organization, company, association, etc."

Brother, Can You Spare Some Stock?

Even if Craig didn't become a pot stock millionaire in 2013, there's always 2014, right?

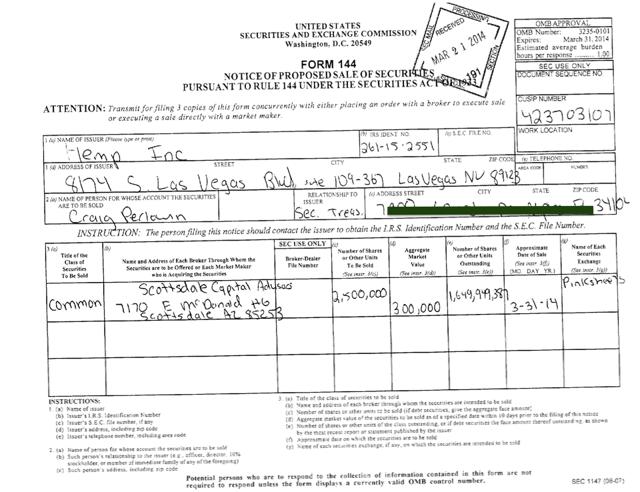

Unfortunately for Craig, he ran out of his pot stock. Thankfully, big brother Bruce has plenty of shares to spare.

After buying some 10 million shares from his brother at an undisclosed price, on March 21, 2014 Craig filed to sell 2.5 million shares for $300,000 and on Nov. 6, 2014, Craig filed to sell 8.7 million shares for $487,500.22

Disclosed

|

Proposed

|

Adjusted

| |

Profits

| |||

2014

|

-

|

$778,500.0

| |

2013

|

$1,105,697

|

$919,351

|

$596,000

|

Shares Sold

| |||

2014

|

-

|

11,200,000

| |

2013

|

23,607,441

|

31,299,274

|

12,500,000

|

Low

|

High

|

Mid

| |

Est. Total Profits

|

$1,130,016

|

$2,026,365

|

$1,374,500

|

So it's possible that Craig became a millionaire after all. It just took him two years.

Charitable Bruce

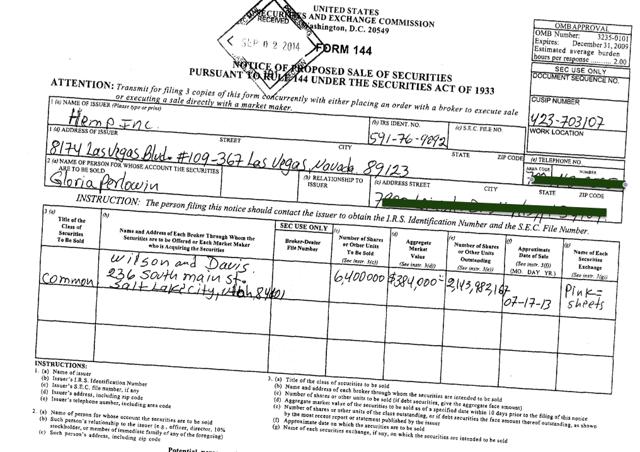

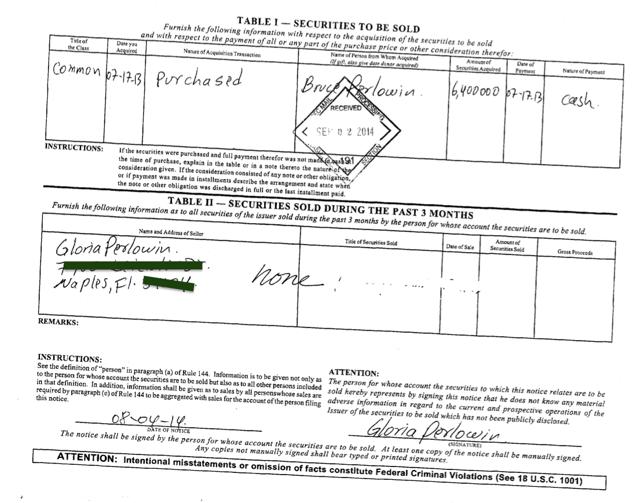

Brother Bruce not only helps out his brother in 2014; it looks like he extends the love to his sister-in-law, Gloria.

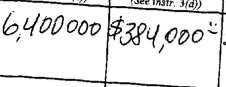

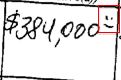

In a random filing, Gloria Perlowin, possibly the wife of Craig Perlowin, filed to sell 6.4 million shares of Hemp for $384,000.

Now, rather than having the form in the footnotes, I placed it in the middle of the article because I want to see if you notice something odd.

Did you catch it?

Yes, that's a smiley face.

I'm sure Gloria is a lovely individual with a great sense of humor.

On the following page, it warns, "intentional misstatements or omission of facts constitutes Federal Criminal Violations." Perhaps to Gloria, 'omitting' a smiley face would have violated federal obligation to disclose just how happy she's going to be with $384,000.23

The Mastermind Behind PotCOM

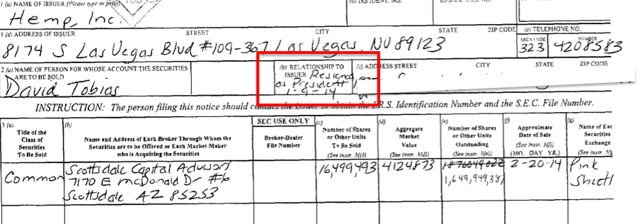

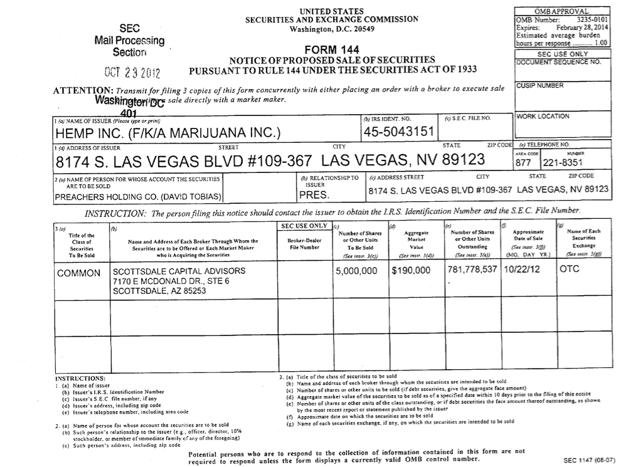

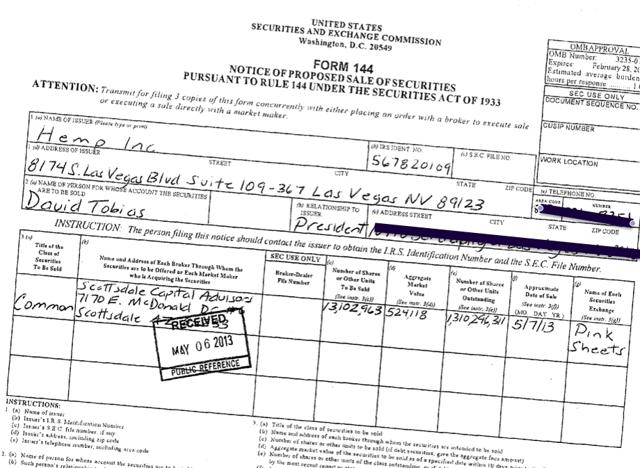

Investors in this space should be relatively familiar with the name "David Tobias." Tobias has had his hand in nearly every major pot stock.

Not that Tobias. No, we're talking about David Tobias, former vice president of Medical Marijuana Inc., former President of Hemp, and most recently, former president of Cannabis Sativa (OTCQB:CBDS). Now, Tobias is soon to be former but still presently president of Wild Earth Naturals.

Like Perlowin, Tobias has been one of the 'pioneers' of stock sector. Surprisingly, Tobias doesn't hide his instrumental role in the sector. On his LinkedIn page, Tobias' bio touts, "The current "PotCom" Explosion, resulting in millions of dollars in Pot Stocks being traded daily, is largely due to his efforts." In other words, Tobias admits that he's helped bring liquidity to the pink sheets.

And he's profited handsomely.

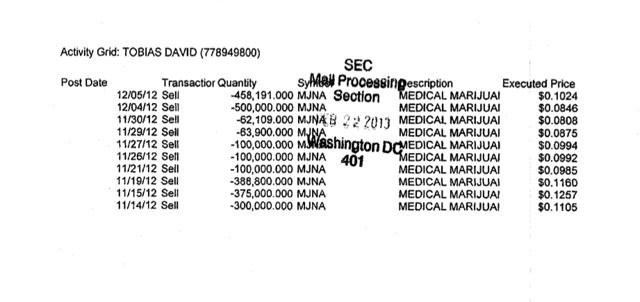

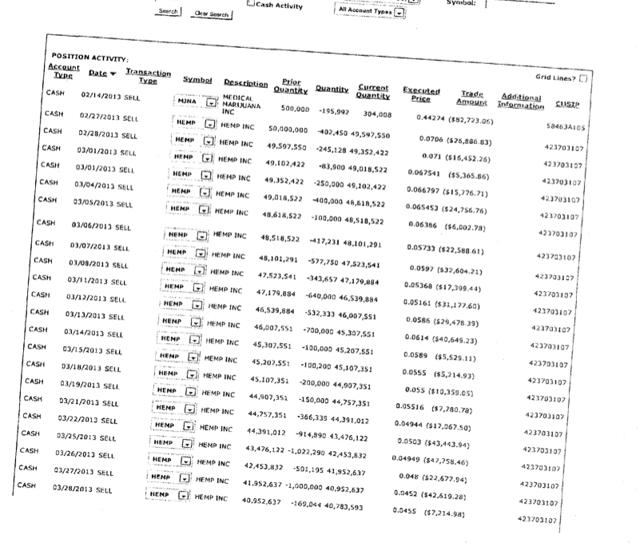

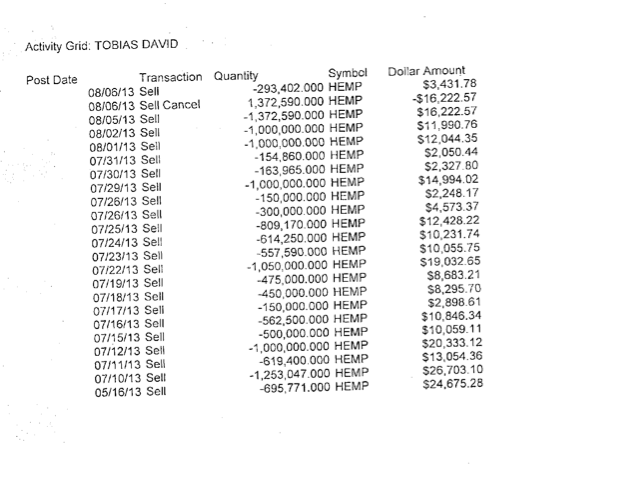

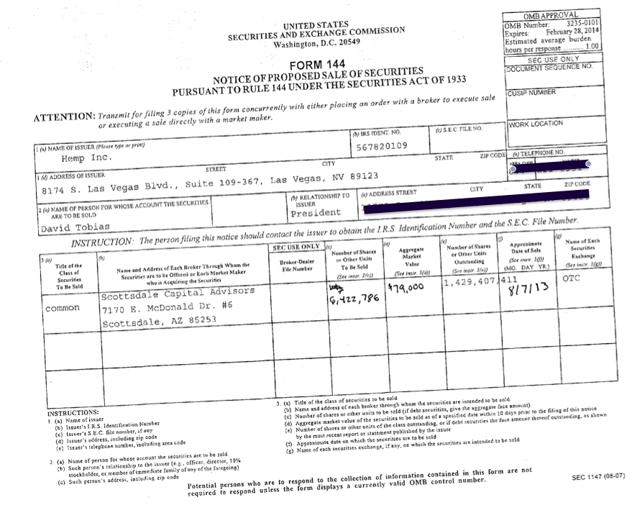

Mr. Tobias is a pot stock millionaire. Between his stock sales of MJNA and Hemp, Tobias has grossed at least $4.3 million from 2012 to 2014.

Most of the trading was done in 2013, but Tobias potentially made the most in 2014.

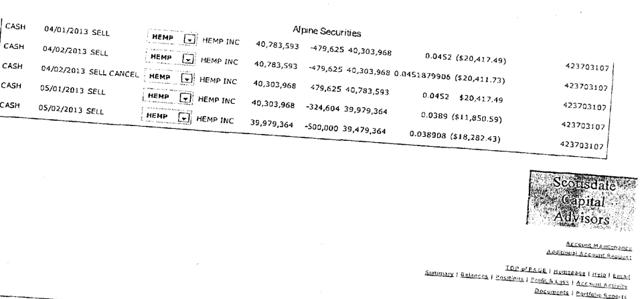

Selling shares owned by both his personal account and his consulting company, Tobias managed to make from his Hemp and MJNA shares at least $450,000 in 201224 and $1.7 million in 2013.25

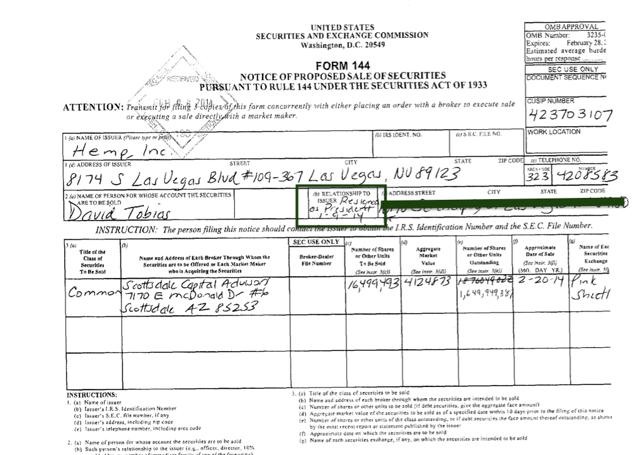

When pot stocks skyrocketed earlier this year, Tobias filed to dump 16 million shares for $4.1 million.26

The date of this filing was Feb. 4th, 2014, but Tobias indicated that he planned to sell by Feb. 20th, 2014.

When looking at the charts, you can tell why Tobias was eager to sell. Hemp shares rocketed from $0.025 a share to $0.25 a share within a week. Tobias also indicated on his filing that as of January 9, 2014, he resigned as president so he should be free to sell the rest of his holdings without having to file any additional form 144s.

Between the 4th and the 20th of February, nearly 2.5 billion shares traded hands. It is very likely that Perlowin could have pocketed his $4 million prior to the stock returning to prior lows.

David Tobias' profits from selling Hemp Shares:

Disclosed

|

Proposed

|

Est. Actual

| |

Profits

| |||

2014

|

-

|

$4,124,873.0

|

$2,062,437

|

2013

|

$839,304

|

$2,494,138

|

$2,570,338

|

2012

|

-

|

$190,000

|

$200,000

|

Total

|

$839,304

|

$6,809,011

|

$4,832,775

|

Shares Sold

| |||

2014

|

16,499,493

|

16,499,493

| |

2013

|

31,189,875

|

57,701,139

|

57,701,139

|

2012

|

-

|

5,000,000

|

5,000,000

|

Total

|

31,189,875

|

79,200,632

|

79,200,632

|

Low

|

High

|

Mid

| |

Est. Total Profits

|

$2,131,249

|

$7,648,314

|

$4,832,775

|

Based on these figures, Tobias David most likely came out with the most from selling his shares of Hemp.

Insider Selling Total

So, how much did insiders make from selling their shares of HEMP?

Profits

| |||

Est. Actual

|

High

|

Low

| |

David Tobias

|

$4,832,775

|

$7,648,314

|

$2,131,249

|

Bruce Perlowin

|

$4,618,794

|

$5,534,297

|

$3,527,863

|

Craig Perlowin

|

$1,374,500

|

$2,026,365

|

$1,130,016

|

Gloria Perlowin

|

$276,641

|

$384,000

|

$172,221

|

Total

|

$11,102,709

|

$15,592,977

|

$6,961,349

|

Within the past three years, insiders of HEMP have become multimillionaires.

| Shares Sold | Profits | Price Per Share | |

| David Tobias | 79,200,632 | $4,832,775 | $0.0610 |

| Bruce Perlowin | 128,285,937 | $4,618,794 | $0.0360 |

| Craig Perlowin | 23,700,000 | $1,374,500 | $0.0580 |

| Gloria Perlowin | 6,400000 | $276,641 | $0.0432 |

| Total | 237,586,569 | $11,102,709 | $0.0467 |

Because Perlowin did not sell in the beginning of 2014 when Hemp hit its highs, he ended up selling twice as many shares and made less than David.

Insiders sold on average right along the moving averages, with Bruce taking the lower band, Craig and Gloria taking the mid band, and David taking the upper band.

Then again, it makes no difference what price Perlowin sells his shares at because even if he can always issue himself more shares.

But he really doesn't need to. After selling 130 million shares, selling some 20 million shares to Craig and Gloria, and even putting up 8 million preferred K shares in escrow, Perlowin still holds over 2 billion shares.

Since he's (theoretically) restricted from selling a maximum of 1% per quarter, it would take him 20 years before he could actually sell his entire holdings as CEO of Hemp based on the current 2.6 billion shares of common stock outstanding. If he were to increase authorized share count, and convert all preferred K and preferred shares into common stock, he could squeeze it into 11.

The day that Perlowin decides to "step down" as CEO will be the day that Perlowin wants to sell the last of his shares without restriction.

What about North Carolina?

To those who think that all of these stock sales were a way for the company to raise capital to invest in the company. Think again.

Yes, a facility was recently acquired in North Carolina for the purposes of hemp production. However, growing hemp is currently illegal in North Carolina. In their last quarterly report, the company discloses that the facility was paid for:

"The Company borrowed $1,600,000 to finance the purchase of the land, building, equipment and to provide working capital on a long term convertible note payable. The land, building, equipment, and 8,000,000 Preferred K shares are pledged as collateral against the Note. The CEO supplied the 8,000,000 Preferred K shares from his own personal portfolio. The Note further required the Company to issued 5,000,000 Common shares, 10,000,000 five year $0.10 Common stock warrants, and six amortizing payments of $296,667 for a total of $1,760,000 beginning on May 12, 2015."

The only money that could come out of Perlowin's pocket would be the money he could make from selling 8 million Preferred K shares, which would dilute into 80 million shares of common stock. But this is just to provide collateral. He didn't actually have to give up any shares.

So now shareholders are left with debt for a facility that can't legally yet grow the crop the business is supposed to be in the business of growing.

So He Sold, And I Hold. Now What?

Insiders sold and took millions. And the company can't grow hemp at their newly acquired facility. Is the investment worth salvaging?

Even if the company starts growing/selling hemp, the company's share structure is too problematic. There are two types of stocks: common and preferred.

Common Stock entitles you to:

- Right to receive a certificate proving ownership of the corporation

- Right to vote for members of the board of directors, stock splits

- Right to obtain limited financial information about the company

- Right to corporate profits

- Preemptive rights to (the right to buy new shares at a discount) to keep the percentage of ownership the same**

Preferred Stock

- Considered a "fixed income security."

- Pays a dividend

- No voting rights

- Has priority over common stockholders on earnings and assets in the event of liquidation

In Hemp's initial disclosure statements, the company specifies certain provisions of its common and preferred securities that essentially undermine the rights of common stock ownership:

1) "Common stock does not have any preemptive rights"

2) "When dividends are not paid on Preferred stock for one year or more the Preferred stock carries voting rights at the ratio of 2.5 votes per share of Preferred."

Without preemptive rights, Hemp stock holders do not have the right to buy new shares at a discount in order to keep the percentage of ownership the same. And as long as the company does not pay a dividend, preferred shareholders could have trump voting power.

Share structure:

| Share Structure of Hemp | ||||

| Common Stock | Preferred Stock | |||

| Common | Preferred | Series K | Series Q | |

| Authorized | 3,000,000,000 | 500,000,000 | 250,000,000 | N/A |

| Voting | 1 | 2.5 | 2.5 | N/A |

| Outstanding | 2,673,989,058 | 118,480,378 | 157,696,253 | N/A |

| Conversion | 1:1 | 1:2.5 | 1:10 | 1:100 |

| Converted | 2,673,989,058 | 296,200,945 | 1,576,962,530 | 0 |

| Total shares | 4,547,152,533 | |||

The company has the right to issue officers preferred shares that end up having a diluting effect on ownership since common stock only counts for 60% of the voting rights if all preferred shares were to be converted.

The problem is that as a "growth" company, preferred shareholders cannot reasonably expect to receive dividends so this dilutive effect will be the status quo. If/when the company becomes profitable, there's little in the way of protecting current common stock owners' rights.

Unless shareholders wishing for a change collectively accumulate 2.5 billion shares, management owns the company. Effectively, the share structure undermines nearly all of rights of common stock ownership. New management could not fix this.

Even if a shareholder or shareholders were to try to take an activist position, owning 2.5 billion shares of Hemp at 0.03 would be the equivalent of $73 million. There are stocks that trade on the Nasdaq that you could buy for much less. As it stands, the market cap of this company diluted is $157 million. That's a lot of money to be shelling out for a company that's has negative cash flows.

Conclusions

DefinitionInvestment: an act of devoting time, effort, or energy to a particular undertaking with the expectation of a worthwhile result.

Going back to the early days of Hemp and seeing what little has changed, with the exception of dilution and insider trading, it becomes clear that this has been the purpose of the pot stock sector all along:

- Acquire all the shares of a thinly traded delisted pink sheet stock

- Award shares to insiders

- Accumulate debt owed to insiders and affiliates

- Dilute shares to pay off debt

- Inflate stock prices with hyperbolic press releases with lines like "these stock are going to go through the roof"

- Make millions dumping shares acquired cheaply

While this sums up the pattern in practice of most pink sheet stocks, the scheme usually does not last for more than a year.

Pot stocks are different. It is concerning that Hemp can still generate hundreds of thousands of dollar volume daily, even after several pump and dumps have taken place.

Perhaps what keeps bring investors coming back to pot stocks is the liminal space that marijuana legalization occupies. It is simultaneously legal and illegal. Pink sheet securities kind of occupy a similar space. Although technically legal, pink sheets still are most susceptible to corruption. Perhaps this is why investors look past the fact that most pot stocks are listed on OTC-Link.

The "investment" into pot stocks then isn't the companies themselves but what investors hope the companies will become if/when marijuana is legalized. That's why some investors may be able to look past insiders pocketing over $11 million without having developed revenue generating business operations.

The only operations Hemp Inc has had in the past two years has been dilution and dumping. Many have suspected this was the case. Now we have the insider trading transactions to prove it.

Even with a change in management, the current share structure is extremely unfavorable to investors. Shareholders have been getting a raw deal and continue to pay dearly for it.

In my opinion, the situation is not salvageable.

4

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

(click to enlarge)

(click to enlarge)

(click to enlarge)

(click to enlarge)

No comments:

Post a Comment