Prior to Passage

Prior to passage of the Marijuana Tax Act, hearings were held by the House Ways and Means Committee. Cannabis had been listed as a medicine on the U.S. Pharmacopoeia and had support from the medical community against the sensationalized claims occurring during the hearings.

During a Committee hearing, Dr. William Woodward, legislative council for the American Medical Association, refuted the Act because the stories told were not based on scientific evidence. Unfortunately, Dr. Woodward’s comments were met with disbelief. The Act passed on June 14th 1937 and was implemented in 1938.

The Aftermath

Simultaneously the agricultural economy, which had been climbing in gross farm cash income received by farmers and was finally approaching pre-depression levels, slipped into a micro-recession which lasted until 1940. While the Tax Act may not have been the only cause of the micro-recession, it surely correlates.

Hemp for Victory Spurs Seed Commandeering

World War II brought a boom in agricultural exports spurred by wartime food and material demand. The U.S. was cut off from foreign imports, particularly fiber materials like jute, so the US Department of Agriculture initiated the Hemp for Victory Campaign.

This campaign advocated for farmers and processors to produce hemp materials for war efforts. Facilities throughout Kentucky and the Midwest geared up to manufacture and distribute hemp-derived parachute webbings, ropes, shoelaces and other naval gear.

According to a Kentucky hemp farmer who experienced the campaign first-hand, prior to Hemp for Victory,

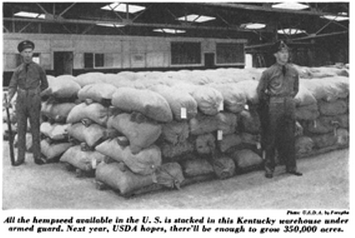

“military officials visited our farm and commandeered all our [hemp] seed stock, 300 acres [of land] and a tobacco barn… to store materials and seed.”JACOB GRAVES, KENTUCKY HEMP FARMER

Once the officials collected and controlled the seed stock, they allocated the seeds back to farmers.

At the time, this allocation was seen as a way to ensure demand was met; however, in retrospect, it seems like a convenient way to acquire all the seed stock to control down the road.

After WWII ended, the federal government possessed the U.S. hemp seed stock, as opposed to farmers. This possession, on top of the licenses and fees that were re-introduced after WWII, made growing hemp even more difficult.

WWII Creates Synthetic Revolution

While hemp truly did help bring victory to the U.S. in WWII, hemp materials were unable to experience the significant post-WWII economic industry growth that other industrial materials experienced. This was in part due to the re-introduction of the Marijuana Tax Act, but it was also in part due to the significant surplus of synthetic alternatives that were developed during WWII.

Similarly to WWI, there were significant quantities of materials remaining after WWII. Learning from WWI, industrialists knew the surplus materials could cause another depression. However, unlike WWI, these surplus materials were not necessarily agricultural products, but rather synthetic materials like nylon and petroleum-derived plastics developed to aid war efforts.

Emigration from Agricultural Backbone

While hemp products continued to be regulated, other natural products continued to lack in consistent quality. Conversely, synthetic materials offered unique consistent quality. These synthetic materials and their petroleum-derived inputs were in abundance, causing prices to plummet.

Industrialist countered the surplus by creating new markets, like Tupperware, to expand synthetic material demand; therefore, preventing another depression and spurring America into one of the largest growth periods ever. The Synthetic Revolution was born.

Simultaneously, families were leaving rural America for urban America and the gap between Gross Farm Cash Income and Net Returns to Operators diverged more than ever. This divergence is still noticed today.

No comments:

Post a Comment